Stillwater - This week in the markets

Higher rates take a back seat to the rolling thunder Putin is sending out.

“This business will get out of control. It will get out of control, and we will be lucky to live through it.”

Beware that infamous line from Hunt for Red October. This business in Ukraine is going to get out of control. While we will for sure live through it, others won’t be so lucky.

We have entered new ground for markets as there hasn’t been a major geopolitical event like this in many years. At least not one that can move markets the way this one promises. Read any report on what an invasion could look like, and you will get the idea that we are about to face some serious instability in the markets. If it’s true that 50% of Russia’s ground combat units are stationed on the Ukraine border, there is no chance this thing doesn’t turn into a live shooting war.

The only year I lost money for the Nuveen Equity Long/Short mutual fund, that’s a flex by the way, was 2011. This was the year the European Union almost collapsed, and volatility was very high. As I said at the time, it felt like you were walking through Harlem. You didn’t know when, but eventually everyone gets mugged. It’s just a matter of how bad it feels. Get long the VIX if you can and pass the Dramamine.

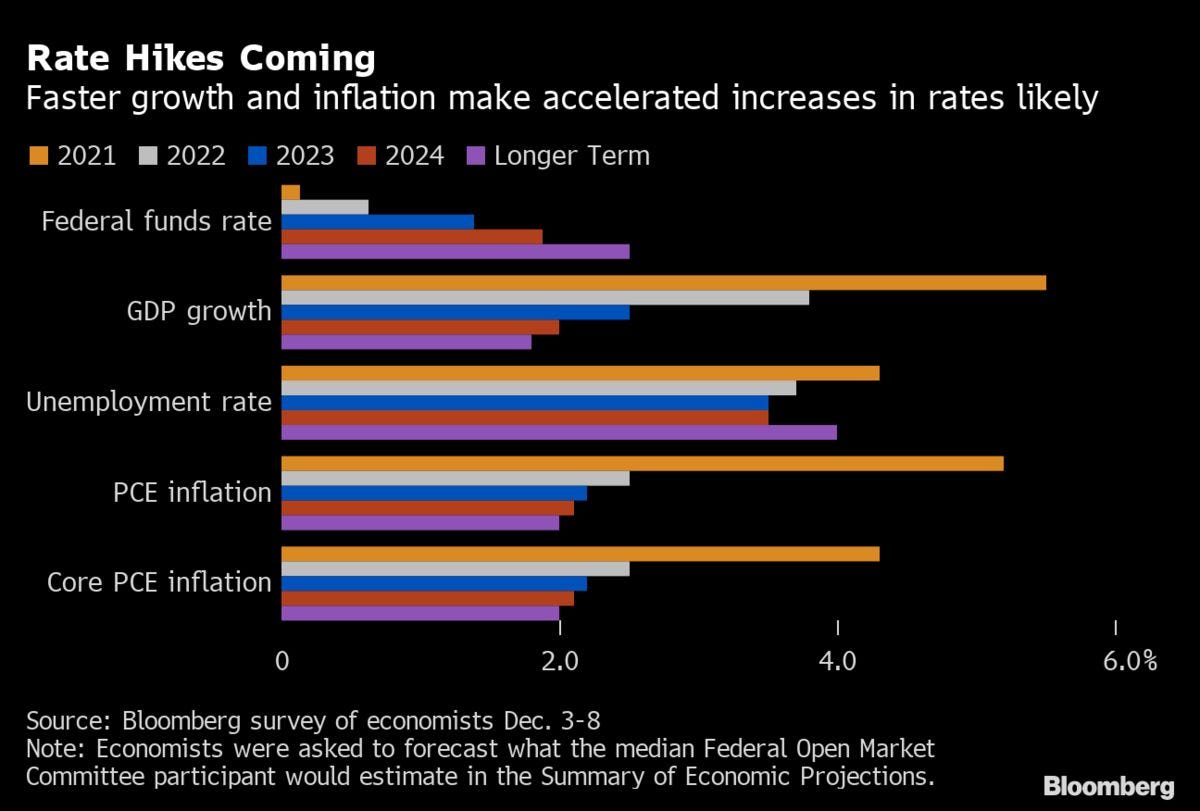

And if that weren’t enough, we got this ray of sunshine from St. Louis Fed President James Bullard in relation to inflation “We’re at more at risk now than we have been in a generation that this could get out of control.” His counsel is for 100 basis points of Fed tightening before July. Because right now, we are coming in hot across the board and the markets are by no means ready for a rate hike regime of that magnitude. Minutes from the January FOMC meeting, released on Wednesday, show they are in less of a hurry than Bullard wants.

In related news, everyone’s favorite innovation stock picker, Cathie Wood, made the rounds this week to talk her book and say that the profitless tech companies she traffics in are selling at bargain basement levels.

“Today we have investors doing the opposite of what they did in the late ’90s. They are running for the hills. It’s risk-off because of inflation and interest rates. And the hills are their benchmarks. They are running to the past,” Wood said.

I hate to say that we’ve seen this movie before, but we have seen this movie before. As many as us old timers remember from 2000, downside is faster when the bubble bursts, and that’s what’s happening now. That said, if you held on for another twenty years, you did just fine. It took you fifteen years of that to get back to even.

Speaking of crashes, we are still crowing about our call of the year that Facebook was a short, and no fund manager should own it. This week the stock was trading down almost 40% on the year, a huge number for a giant of the tech world. To give you an idea of what that looks like in market value, the company at one time was worth north of a trillion, and today it stands at roughly half that number. A billion here, a billion there, and soon you are talking about real money. You’ve come a long way, boys.

Bloomberg ran an interesting piece this week on changes at the top of the Facebook org chart. In it they reported that founder Mark Zuckerberg has been spending his days hiding out in Hawaii. I would too, I guess. Because 58% of $600 billion is still a lot of billions. One more from the op-ed pages of Bloomberg jokes at the moniker Zuck wants people to call each other. Wait for it, Metamates.

That’s it for a week that was pretty much as advertised. We see it as a trilogy. Revelation. The Struggle. Acceptance. The markets just got through Revelation; things will be different this time. Get ready for The Struggle. Ya’ll know what it’s going to be, right?

Next week is a short one, so then will the market notes be. We will be filling more of the pages with diversions, adventures, and good things to look forward to as the year unfolds. Because there comes a time in one’s life where you just must decide if you want to get busy living or keep on dying. We are super bullish on the former and think the latter doesn’t sound like much fun. Good on you, Andy.